Goal & Purpose

Verification

Process Automation

On-Premise

Integrated AI

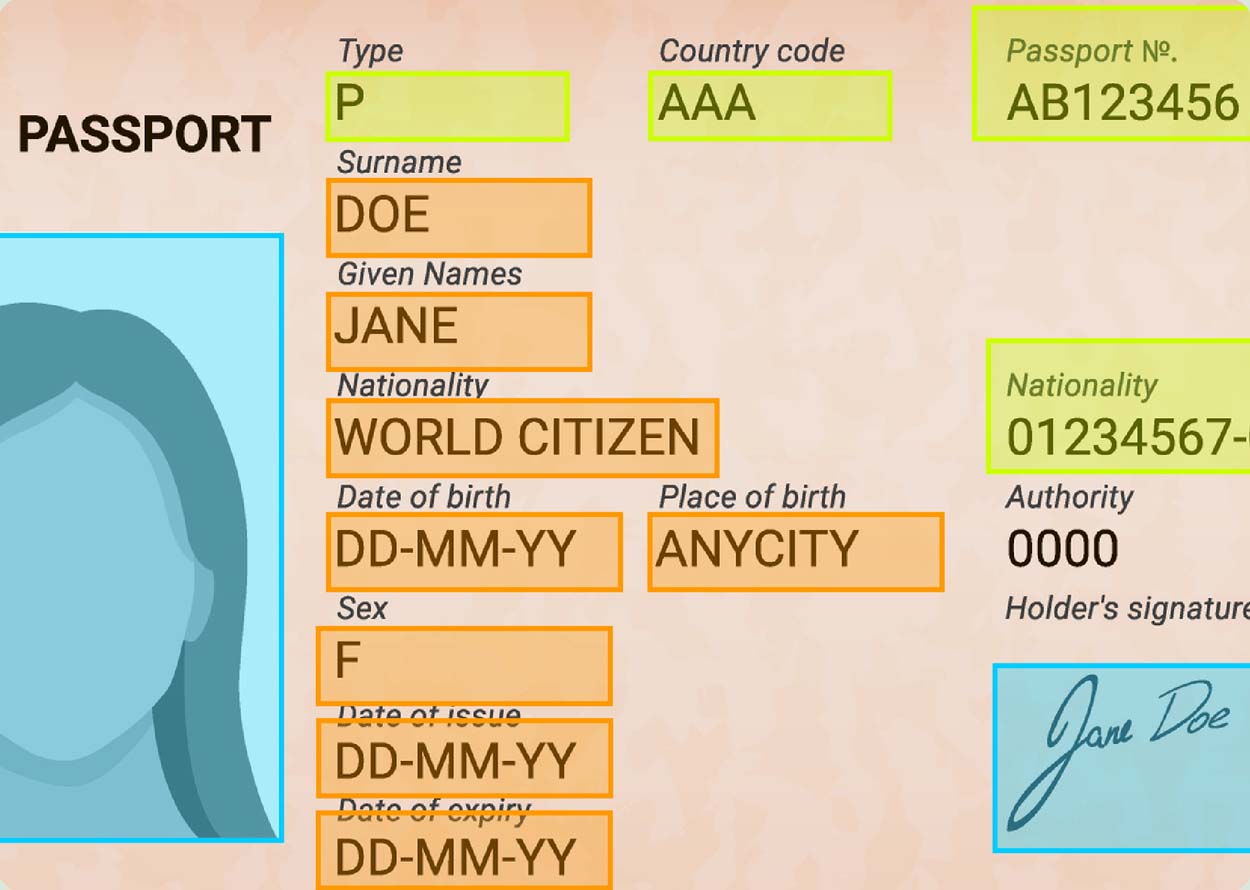

KYC: Advanced Data Extraction

Interplay® can extract structured data from smartphone photos of IDs, including driver's licenses, passports, etc. This allows a quick verification and Know Your Customer (KYC) for anyone looking to verify account owners, buyers, or sellers.

Interplay is trained to recognize a myriad of document sources, data fields, and known structured data models. It is currently deployed in Asian financial institutions to verify transactions.

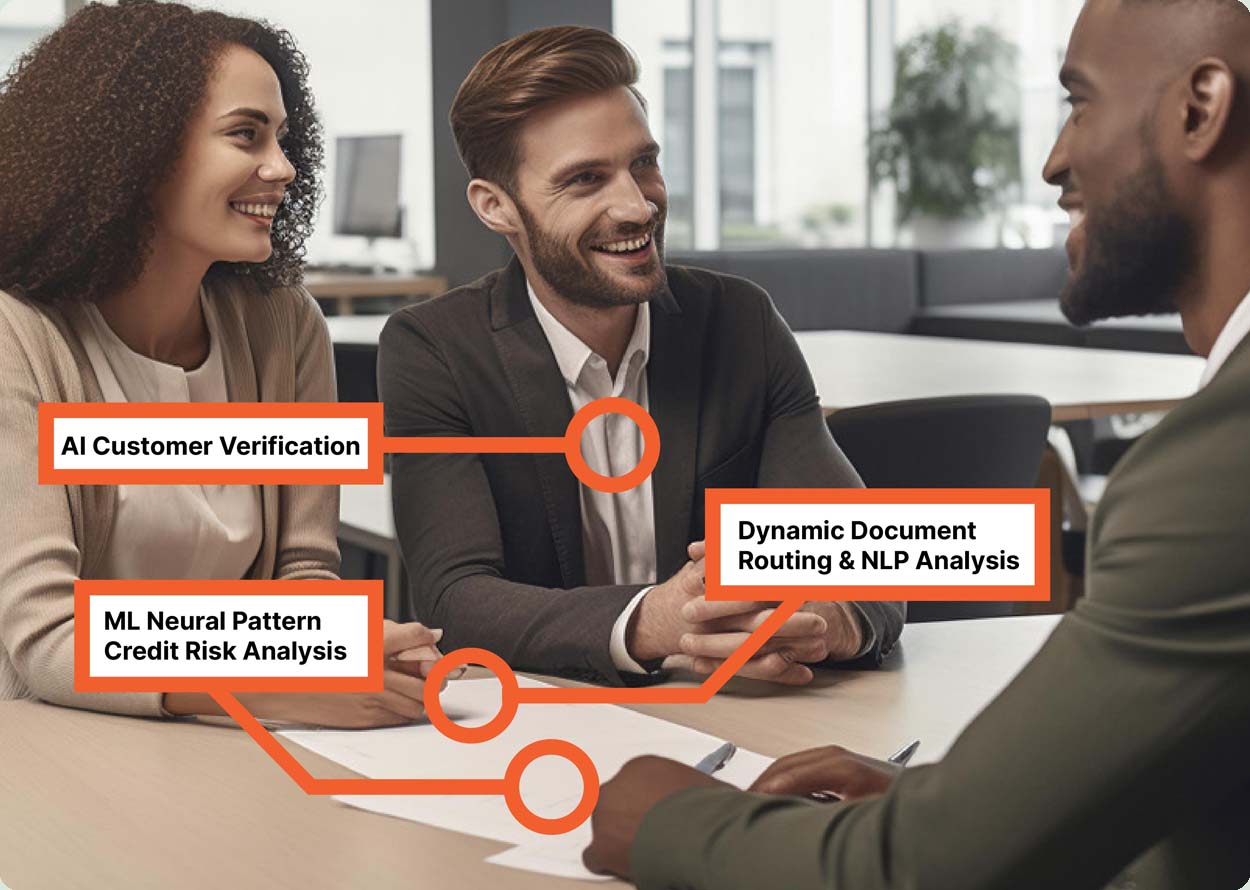

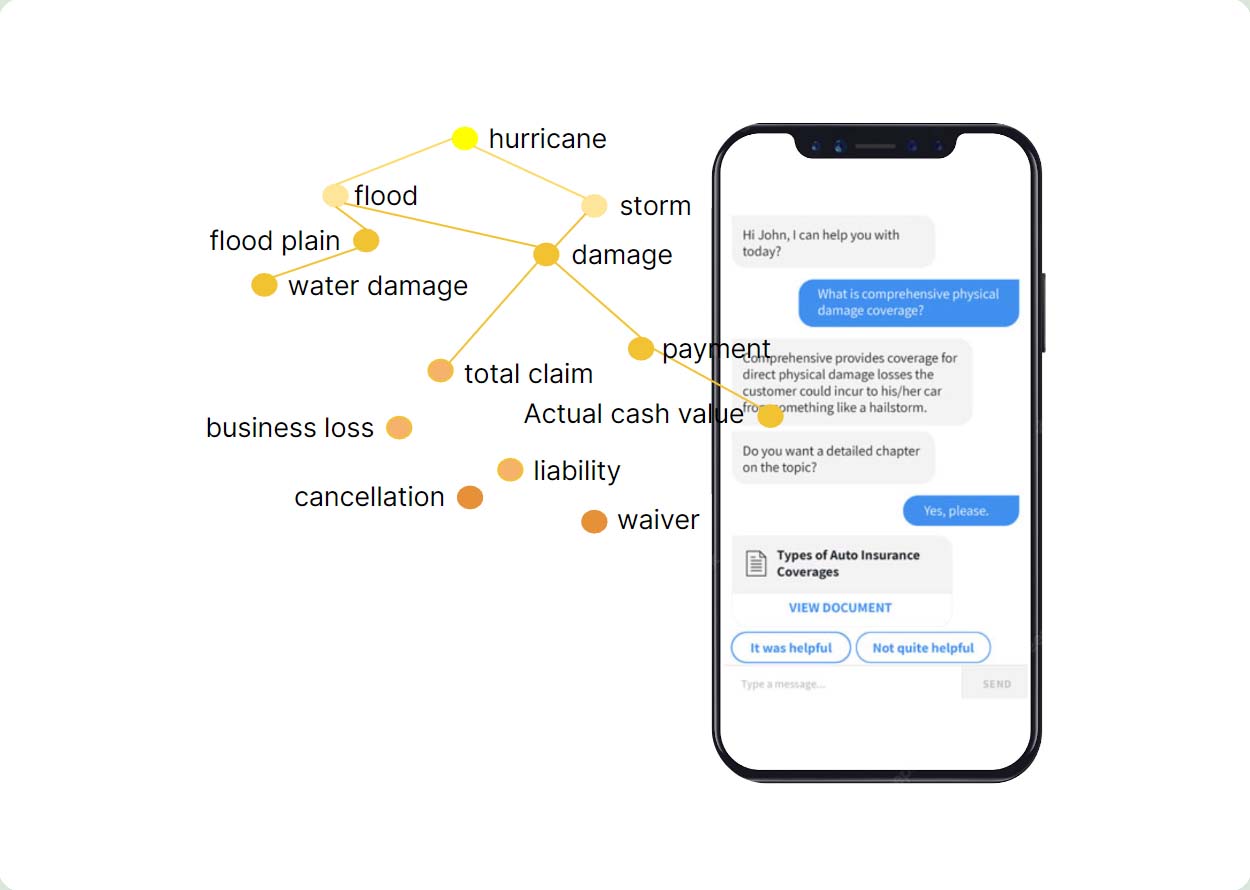

Neural Patterns for Mortgages

By building an NLP word cloud based on the terms and text of mortgage applications, we can model trends, find “hotspots”, and uncover relationships between terms for faster processing and smarter overall market analysis.

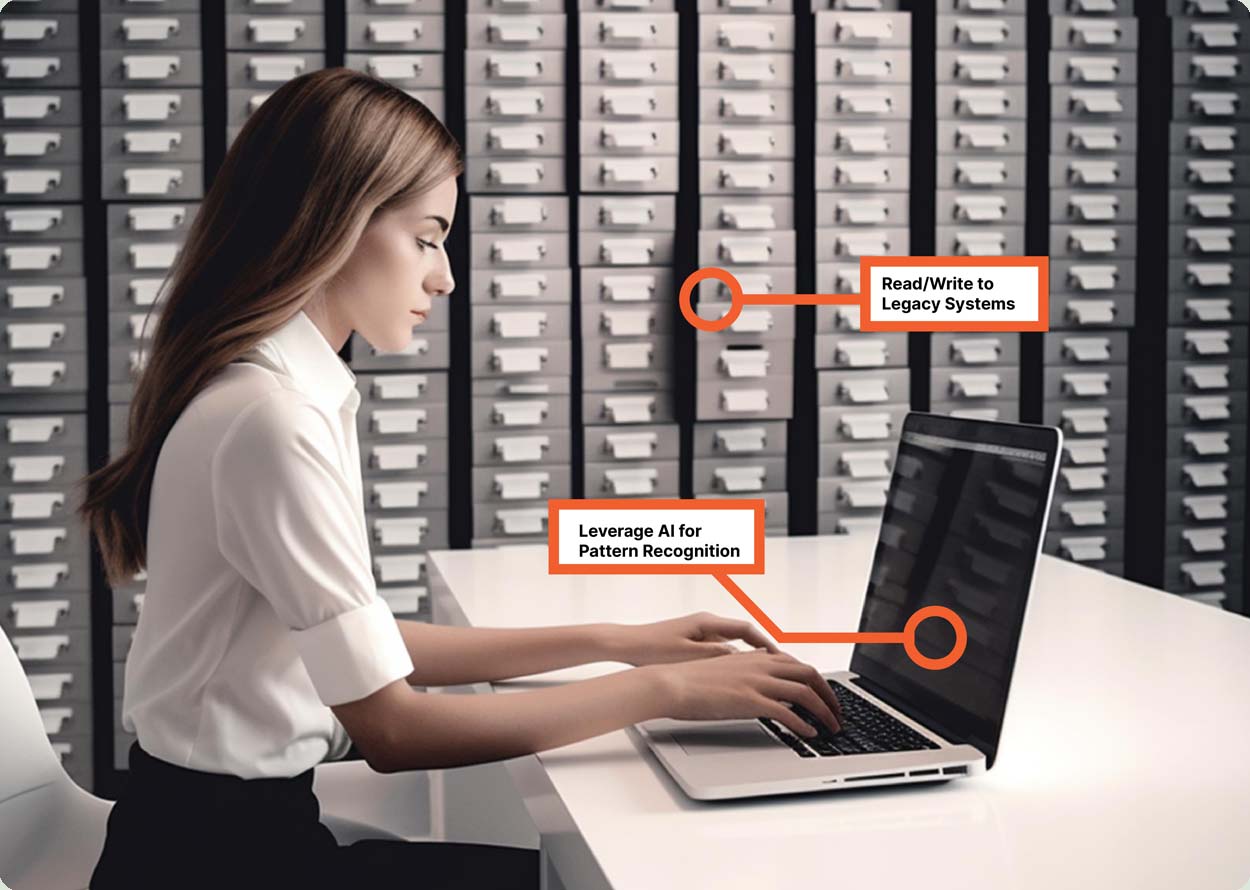

Legacy System Integration

Financial institutions have an enormous investment into existing legacy systems that have functioned for years or even decades without major disruption. CTOs are faced with the challenge of protecting this investment while also incorporating new technologies.

Interplay can connect modern AI engines to legacy systems that may not have APIs available: text scraping, RPA, ANSI feeds, etc. can all work inside an integrated low-code application flow.

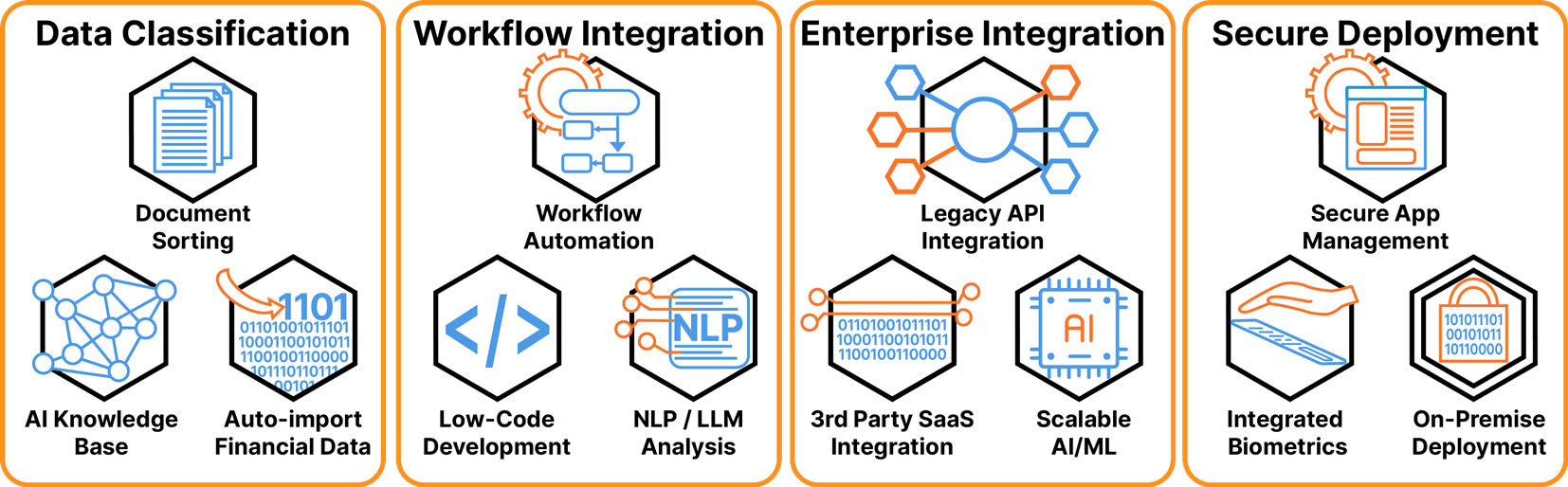

System Flow

On-Premise Deployment

Enterprise banking demands on-premise servers for security and speed.

Interplay runs on data-center hardware and edge servers wherever remote or bandwidth-constrained locations require AI and applications for the organization.

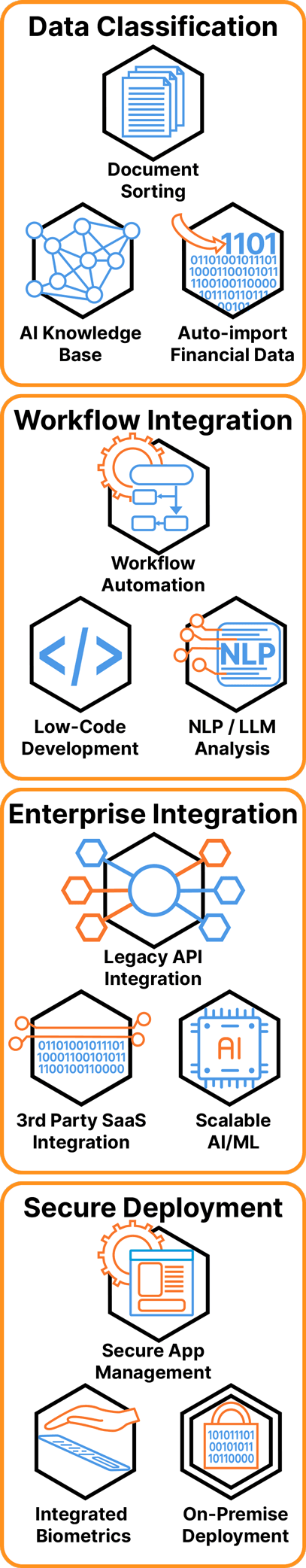

AI Structured Data Document Verification

Interplay handles document extraction for Asian Banks across multiple languages and character sets. The AI is trained on trade finance documents and import records. This produced AI models with millions of pre-trained data points.

This AI improves trade finance and other banking document verifications and routing. Verification includes original document copy classifications as well as seal and chop extractions. Automation minimizes manual human hand-holding for advanced job tasks, bringing efficiency and accuracy.

AI Dynamic Contract Analysis

Contracts held by clients can be scanned and instantly sorted by the recognized entities and topics covered. The text of the contracts and documents can build the NLP recognition engine for custom AI training, which builds a stronger proprietary knowledge base. All these documents then start into an automated workflow as determined by internal managers.

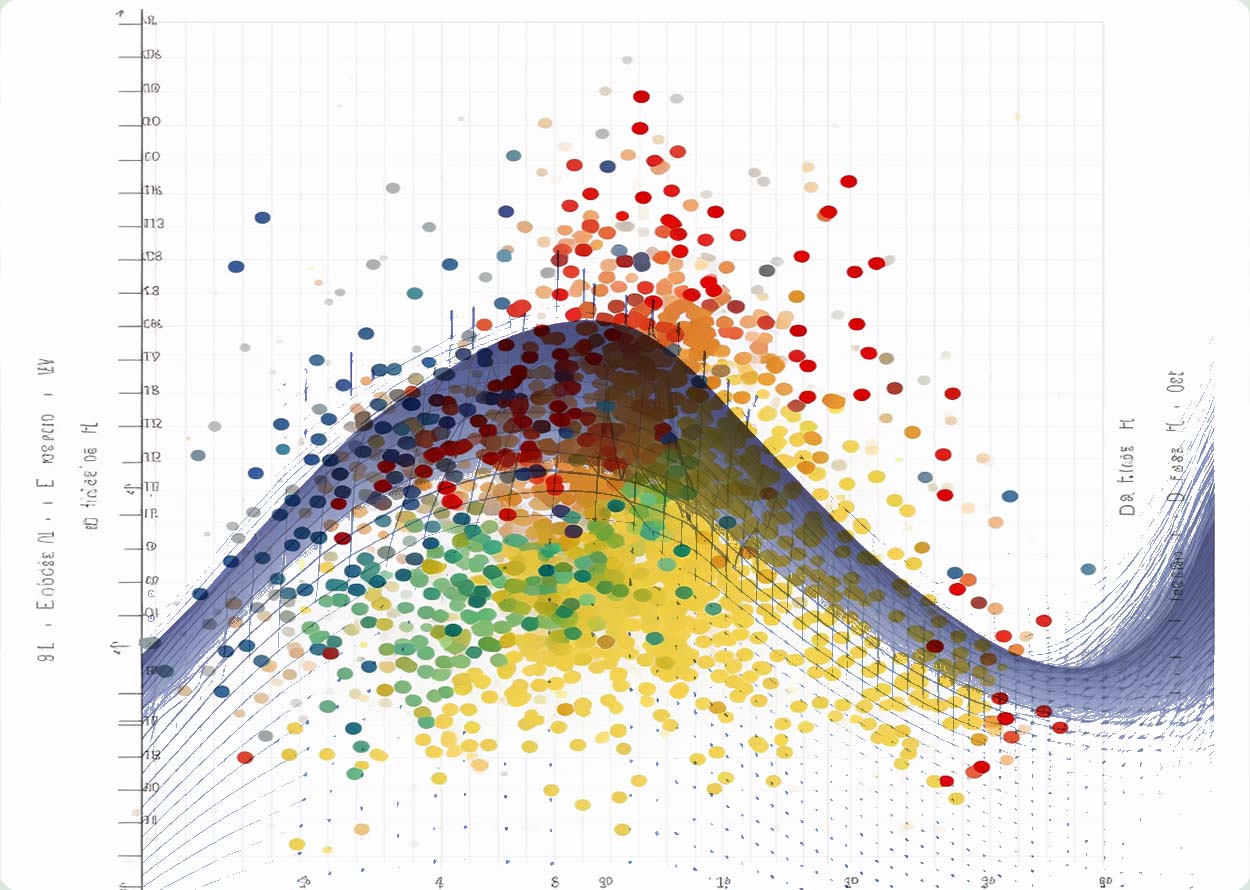

Credit Risk Patterns via Neural Modeling

Credit risk analysis is one of the strongest cases for neural modeling to recognize patterns. With ever-changing market conditions, ambiguously defined customer groups, and varied asset profiles, traditional risk profiling is rife with misclassifications.

When neural network models are applied to customer and asset data sets, patterns are found, trends are recognized, often in unconventional and unexpected ways.

Financial Data Extraction

Workflow Automation: Legacy←→SaaS

AI/ML Management for Loan Queues

AI for Smart Customer Chatbots

Biometric Verification

AI/ML Classification for 3rd Party Data

Synthetic Data for Customer Privacy

Fully Secure Architecture